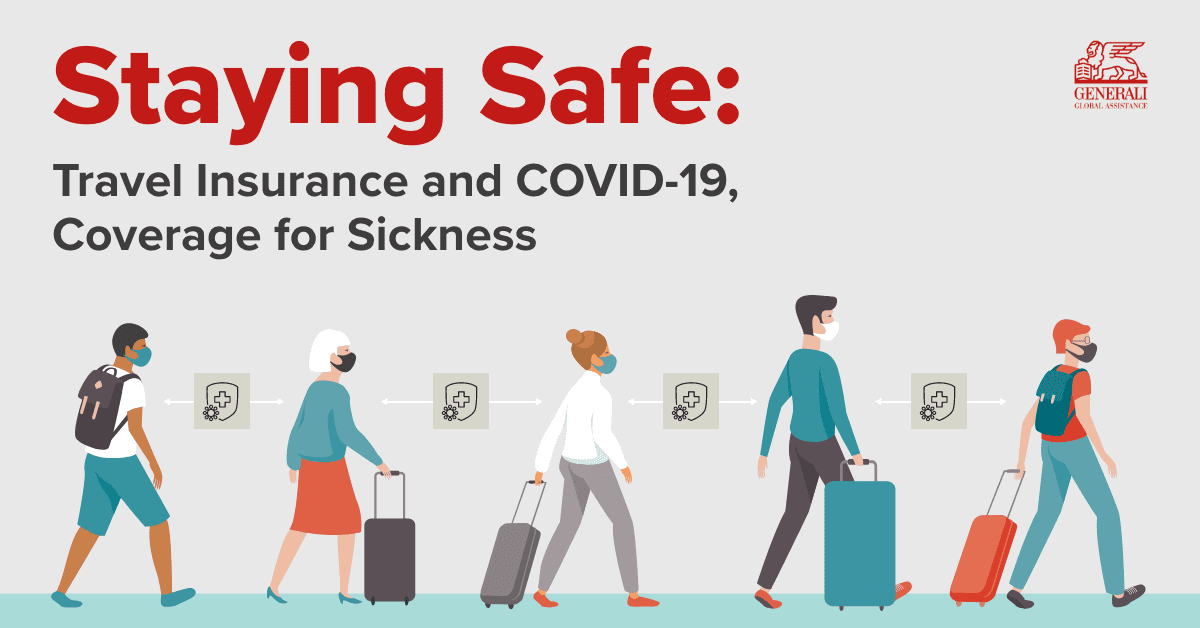

Staying Safe: Travel Insurance and COVID-19, Coverage for Sickness

Health, safety and financial concerns are key considerations for today’s traveler and property manager. While you do your part to enforce cleaning protocols and make sure your rentals are as safe as possible, and as your guests continue to look for ways to get away from home without compromising safety, we at

Generali Global Assistance would like to share how travel insurance can help during these times. Specifically, we want to make you aware of the ways you can rely on travel insurance in the eventuality of a guest getting sick with the virus, either before or during a trip.

What Travel Insurance Can Do

Trip Cost Coverage

Sickness is one of the most common reasons for purchasing and utilizing travel insurance. This was the case prior to the COVID-19 pandemic and remains so today. Although COVID-19 is a known event and has been for some time, travel insurance continues to provide coverage for COVID-19 sickness. This choice is one that Generali and other major travel insurance providers decided to make when confronted with the COVID-19 crisis. If a guest, family member, or travel companion has to cancel or interrupt their reservation because they are sick with COVID-19, travel insurance provides reimbursement for the prepaid trip costs. Other guest expenses are also covered, such as out-of-pocket costs for overnight lodging, meals, and local transportation during a trip delay and additional transportation costs for guests to return home or rejoin the trip earlier or later than scheduled.

Telemedicine and Referral Services

Getting sick while away from home is stressful under normal circumstances. Today, the worry of contracting COVID-19 while traveling is universal. While travel insurance can’t keep guests from getting sick, it can help if they find themselves in a scary and difficult situation. During their trip, insured guests receive access to telemedicine services so they can consult a certified physician virtually. 24/7 Travel Assistance is also included, for help anytime.

Coverage for Medical Expenses

When some guests travel away from home, they aren’t only traveling away from family doctors and local clinics, they’re also traveling out of their primary insurance network. In addition to being scary and uncomfortable, getting sick and needing to seek treatment out of network can be expensive. Travel insurance can help if this happens. While telemedicine and medical referral services connect guests with the treatment they need, travel insurance Medical and Dental coverage reimburses the costs. Coverage is provided for amounts that the guest’s primary insurance doesn’t cover, including copays, deductibles, prescriptions, and other expenses. This coverage for resulting expenses is available for up to a year after the guest gets sick on their trip, even after they return home.

What Travel Insurance Can’t Do

In addition to effecting travel restrictions and business closures, COVID-19 has instilled fear and a heightened sense of caution in the travel community. Adhering to restrictions is a responsible choice and feeling afraid to travel or not wanting to travel are relatable feelings. Unfortunately, travel restrictions, shelter in place orders, fear of travel, and not wanting to travel because of COVID-19 are not covered reasons for cancellation under most travel insurance plans. Plans include defined lists of covered reasons that qualify travelers for refunds, such as unforeseen sickness. Although many travel insurance plans cannot cover pandemics and other known events, coverage for COVID-19 sickness remains available. Other reasons related to COVID-19, however, will most likely not be covered.

How Claims Work

If an insured guest has to cancel because of COVID-19 sickness or another covered reason, they can start their claim online at Generali’s eClaims portal. The portal walks the guest through a few prompts and asks them to provide supporting documents, such as a signed physician’s statement from the treating doctor. Once the claim is started, it is assigned to a representative, who will reach out to your guest directly.

Generali travel insurance products are seamlessly integrated with Track Software. Helping your guests get coverage for their reservations can improve your overall guest experience and you earn revenue while offloading the risk of cancellation. To learn more about travel insurance, call 866-999-4018 or visit Generali online.

About Generali Global Assistance

When you partner with Generali, you’re working with an industry leader backed by one of the world’s largest insurers. Offering travel insurance plans with region-specific coverages and protection against accidental damage to your rentals, our vacation rental insurance programs easily integrate with top software platforms and have helped property management companies earn more revenue and improve guest satisfaction for 30 years. Our success is built on our reputation for assisting travelers in the most difficult of circumstances and delivering vacation rental protection solutions designed to meet your needs.

Travel Protection Plans are administered by Customized Services Administrators, Inc., CA Lic. No. 821931, located in San Diego, CA and doing business as CSA Travel Protection and Insurance Services and Generali Global Assistance & Insurance Services. Plans are available to residents of the U.S. but may not be available in all jurisdictions. Benefits and services are described on a general basis; certain conditions and exclusions apply. Travel Retailers may not be licensed to sell insurance in all states, and are not authorized to answer technical questions about the benefits, exclusions, and conditions of this insurance and cannot evaluate the adequacy of your existing insurance. This Plan provides insurance coverage for your trip that applies only during the covered trip. You may have coverage from other sources that provides you with similar benefits but may be subject to different restrictions depending upon your other coverages. You may wish to compare the terms of this Plan with your existing life, health, home and automobile policies. The purchase of this Plan is not required in order to purchase any other travel product or service offered to you by your travel retailers. Travel retailers receive payment from CSA related to the offer of travel insurance. If you have any questions about your current coverage, call your insurer, insurance agent or broker. This notice provides general information on CSA’s products and services only. The information contained herein is not part of an insurance policy and may not be used to modify any insurance policy that might be issued. In the event the actual policy forms are inconsistent with any information provided herein, the language of the policy forms shall govern.

Travel insurance coverages are underwritten by: Generali U.S. Branch, New York, NY; NAIC # 11231. Generali US Branch operates under the following names: Generali Assicurazioni Generali S.P.A. (U.S. Branch) in California, Assicurazioni Generali – U.S. Branch in Colorado, Generali U.S. Branch DBA The General Insurance Company of Trieste & Venice in Oregon, and The General Insurance Company of Trieste and Venice – U.S. Branch in Virginia. Generali US Branch is admitted or licensed to do business in all states and the District of Columbia.

A11052102