TrackDistribution: Bulk Editor, Airbnb Bookings, Booking.com Tax Tool

Track Product Updates

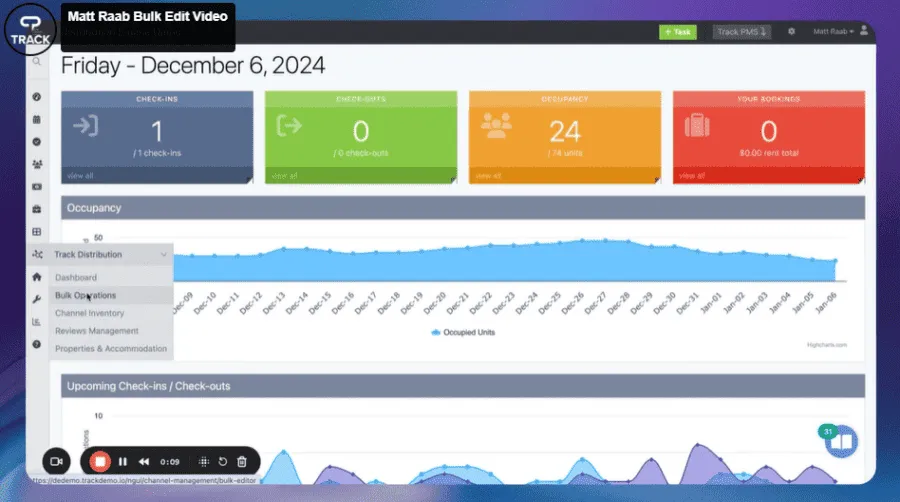

TrackDistribution: New Bulk Editor Feature

Track introduces new, customizable fields that can now be seamlessly integrated into the bulk editor field. This enhancement is designed to increase efficiency.

To see these powerful new capabilities in action, we invite you to watch an insightful product demonstration led by our Senior Product Manager, Matt Raab. Discover how these updates can transform your experience and optimize your processes.

TrackDistribution

Protect Your Short-Term Airbnb Bookings

To comply with local regulations Airbnb has the ability to change your length of stay requirements and override what you had set on your listing. This means a listing you have permitting to book for short term stays may be set to long term stays only on Airbnb without notice to the property manager. Track makes it easy to research your existing inventory to find if this has already occurred and has an alerts dashboard and emails to ensure you will be aware if it ever happens again. Some example destinations this may occur in, but are not limited to; Orlando, Florida, Houston, Texas New York City, New York, and San Francisco, California.

Don’t let your property languish un-bookable for short term stays over a licensing misunderstanding, stay bookable this year with TrackDistribution.

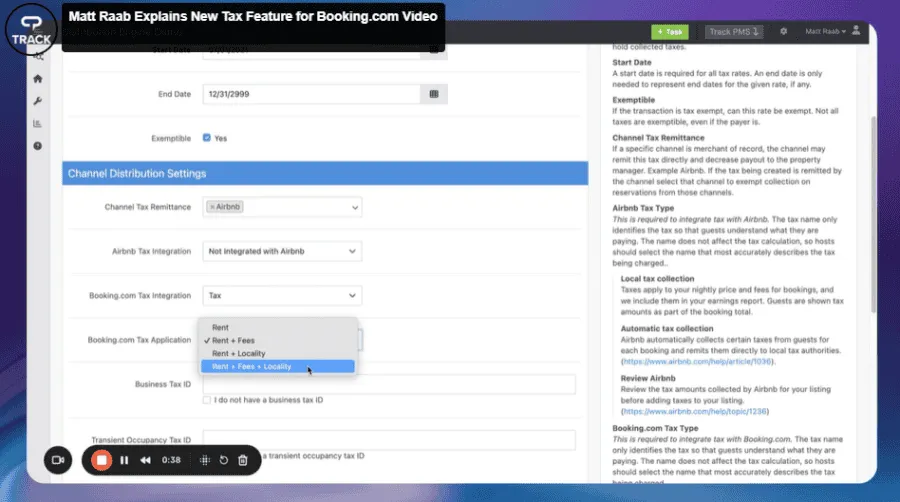

TrackDistribution: Booking.com New Tax Feature

Discover the power of our latest feature by watching the explainer video, which provides a comprehensive guide on refining the process of sending taxes and fees to Booking.com. This new addition is designed to ensure accuracy and efficiency in your financial transactions with Booking.com. Don’t miss out on this opportunity to enhance your operational capabilities and stay ahead in managing your taxes and fees seamlessly.