Trust Accounting Vacation Rental Trust Accounting Software

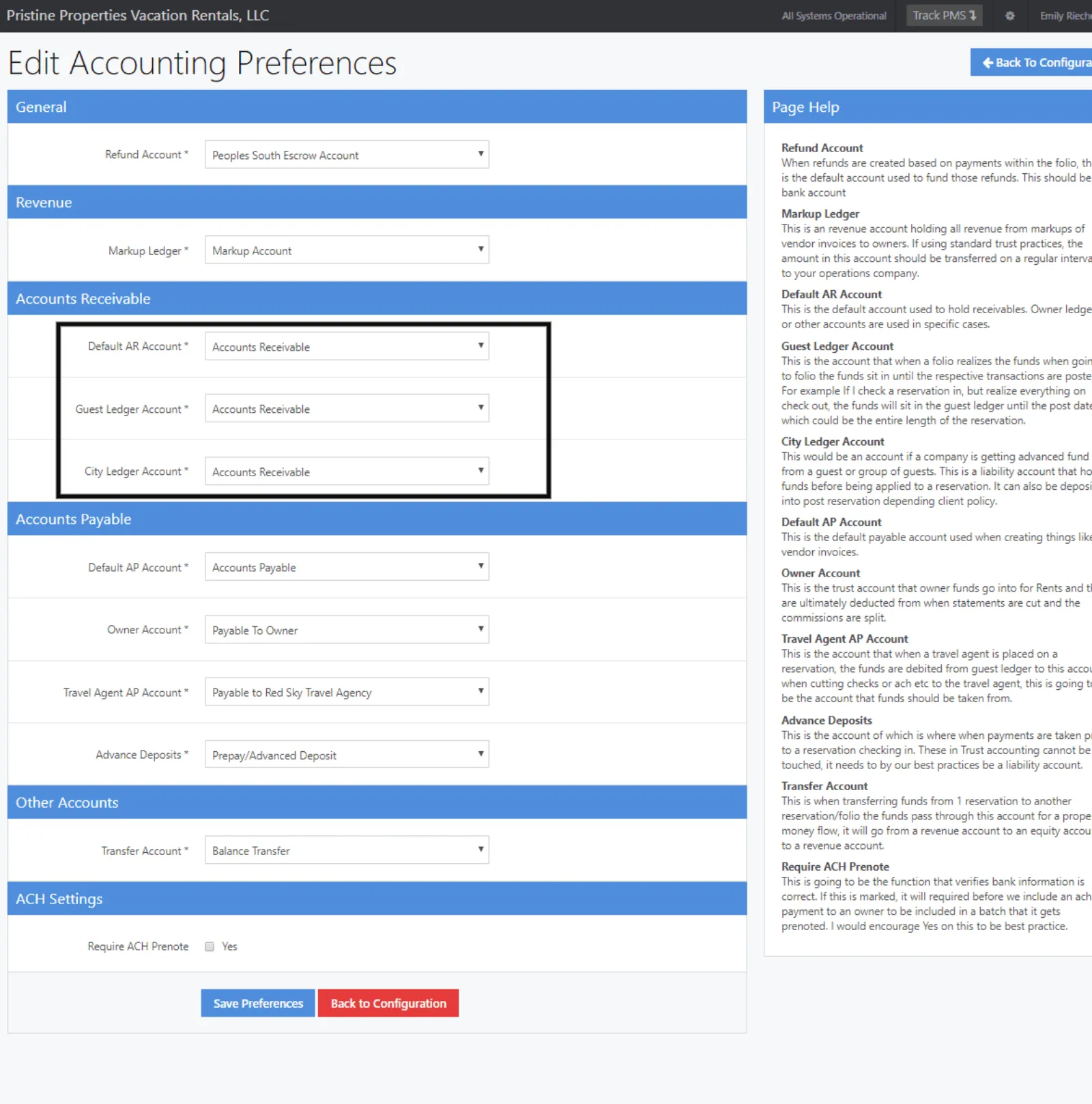

TrackSuite is the only property management solution with trust accounting at its core. Ordinary accounting software isn’t made to handle the unique needs of short-term rentals. Ours is. Best of all, it can easily be adapted to your situation.

Tired of Workarounds?

Got a complex tax situation? Tired of month-end taking forever? Track’s trust accounting solves for these and many other problems. Track customers rely on our long history of trust accounting expertise to ensure smooth financial processes and accurate transaction processing.

Trust Accounting Features

Get StartedRevenue Recognition per Stay Type

Reservation types can be configured to recognize revenue individually.

Expedited Month End

An overview of income, occupancy, availability and work orders

Reservations

Reduce the time it takes to complete your month-end process with automatic revenue posting and statement review screen.

Multiple Tax Policies and Districts

Diversifying your portfolio? Track can be configured for multiple tax set-ups based on the unit’s locations.

Gross Receipt Taxes

Certain locations require taxing owners based on their earned revenue. In addition, the IRS requires that you withhold 30% of foreign owners’ earnings.

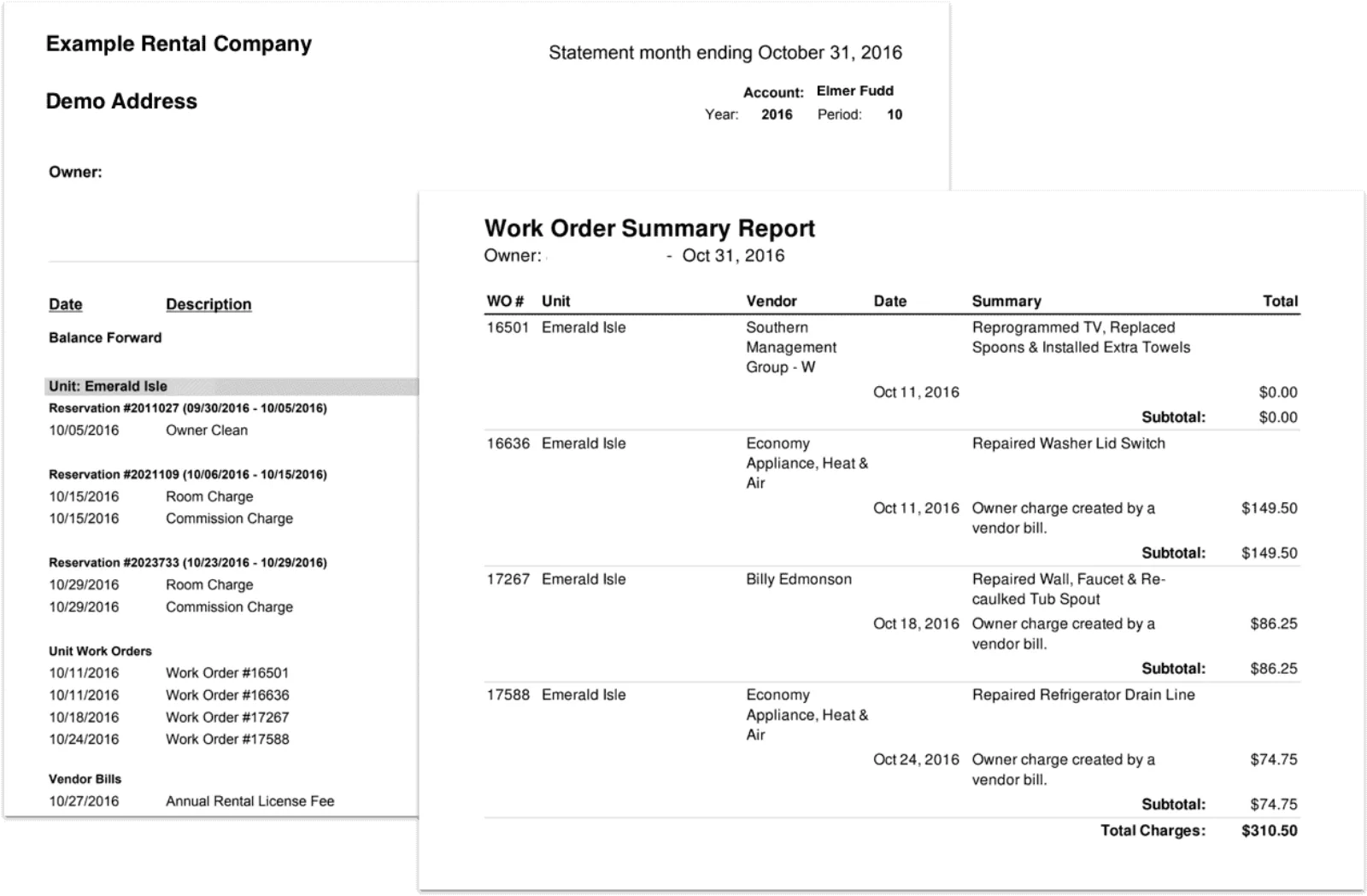

Weekly or Monthly Owner Statements

Owner statements can be processed either weekly or monthly.

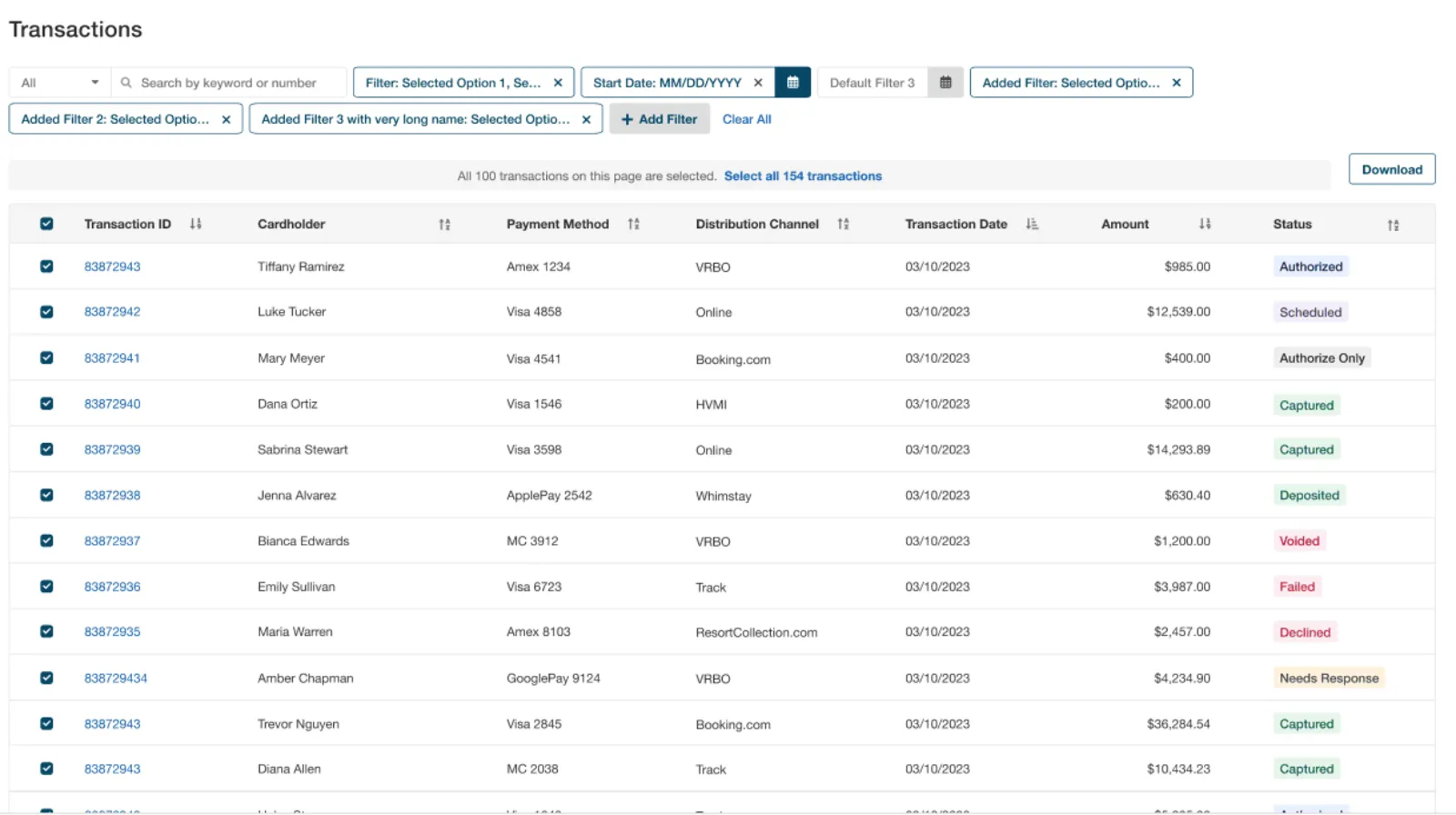

Automated Guest Payments

Track can collect daily payments due based on your deposit policies.

Deferred Owner Charges

Stay in compliance and avoid owner deficits.

Airbnb Tax Integration and Remittance

Automate tax remittance with built-in Air Bn’B tax integration.

60+ Accounting & Owner Reports

Track offers numerous reports to support your accounting needs.

Made By and For Trust Accountants

Our free resource, “Track’s powerful and accurate trust accounting features are often a big reason why customers choose Track. This short guide goes into greater detail about these features and how they can simplify the most complex tax situations.