The Cost of Inaction: How, When, and WHY to Make Your Move in a Challenging Market

Five strategies to pull ahead and win in 2024

We all have something we wish we hadn’t waited to do. Ask somebody out. Go to grad school. Clean the gutters. Sometimes, the cost to us is emotional, e.g. regret. Other times, it can be measured in dollars and cents. Let’s call it the cost of inaction.

Fear is usually in play. Sometimes, that fear is based on concrete facts or past experiences. But usually, it’s based on a story that we tell ourselves. She’s out of my league. I’m too old to go back to school. The gutters can wait until spring.

We live in uncertain and chaotic times. The US economy is either doing well or terribly, depending on whom you ask. It doesn’t seem like the right time to invest in your hospitality business.

However, this might also be the exact right time.

Where we’ve been and where we’re at

The short-term rental market has predictably cooled off from its extraordinary stretch a few years ago, but stability appears to be close at hand. Here are some notable figures from AirDNA’s 2024 Outlook Report:

In 2023:

- Supply growth far outpaced demand growth, though demand is on the upswing so far this year.

- RevPAR dropped by almost 5% in 2023, the first such decline in a decade.

- Aggregate ADR was lower than the previous year.

- Supply growth in 2021 and 2022 had a significant negative impact on 2023 occupancy.

- Rising interest rates and home values have more than doubled the typical payment for a new mortgage.

- A big reason for the COVID boom was a huge increase in domestic travel. Summer 2023 saw international travel grow at 3X the rate of domestic travel.

But the market hasn’t cooled off as badly as you might think:

- The predicted recession never materialized, and US GDP is growing again.

- Unemployment has consistently been below 4%.

- From December 2022 to December 2023, US inflation dropped from 6.45% to 3.35%, a decrease of 48%.

- The decline in occupancy since 2021 appears to have leveled out.

2024 is shaping up to be a market-correction year:

- Inflation is expected to decline further and is currently outpaced by wage growth.

- Most markets (but certainly not all) are seeing demand growth so far.

- Occupancy seems to be returning to a pre-COVID equilibrium

- Though revenue is down overall from the pandemic highs, Key Data indicates that it is still approximately 26% above 2019

- We’re not out of the woods yet, but there are reasons to be cautiously optimistic. It boils down to the alignment of supply and demand and continued economic uncertainty in an election year.

Ready, set …

Hospitality isn’t a sprint—it’s a marathon. And winning a long race boils down to two things: Fitness and strategy.

Imagine you’re keeping pace with the pack. Eventually, you must decide whether or how to set yourself up for a win. Pull ahead early, and you might build an insurmountable lead. But there’s a risk: If you burn too much energy in the process, you won’t have enough left to hold your lead during the final sprint. Similarly, if you wait too long to turn on the jets, a competitor might be too far ahead to catch.

There is no right answer. Watch any distance race, and you’ll see examples of both strategies at play. Sometimes, the winner builds an early lead and never lets go. Sometimes, the winner makes a move in the final turn and has the reserve energy to overtake the leader. In either case, the winner chose the right time to act based on their fitness level and strategy.

Only you can know your “fitness” and which strategy will work for you. However, the data indicates that we’re nearing the final turn. Your competitors will wait until the last moment to make a move if they make one at all.

That creates an opportunity for you, but also an opportunity cost if you miss your window.

Strategic considerations for growth in a down market

In strong market conditions, you don’t have that much insight into what your competitors are doing or planning. All you know for sure is that they’ll try to capitalize on strong demand just like you.

In a sluggish market, however, you have a much better idea of what your competitors are up to, which is waiting and seeing.

If that’s where you’re at, you can still turn a weak market to your advantage. For example, you can finally refresh your marketing or go aggressively after new owners. However, we believe that strategic investments now will pay off down the road.

Here are some strategies for winning the current STR race:

- Technology upgrades: If upgrading or consolidating your tech stack has been on the back burner, does it make more sense to tackle that while occupancy is low or high? The unavoidable business disruption of an upgrade carries much less risk and stress when things are slow. When it picks up again, you’ll be ready.

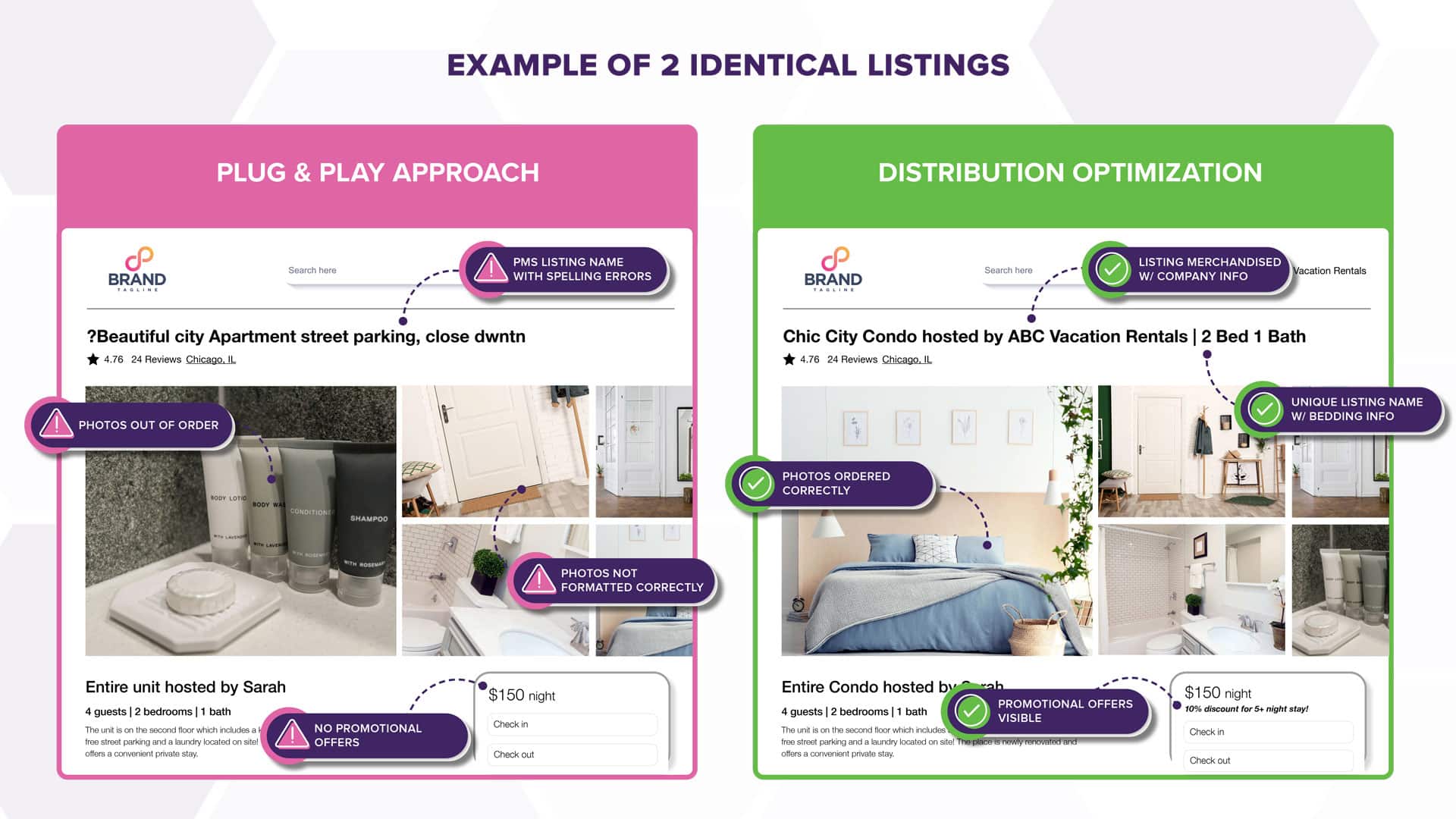

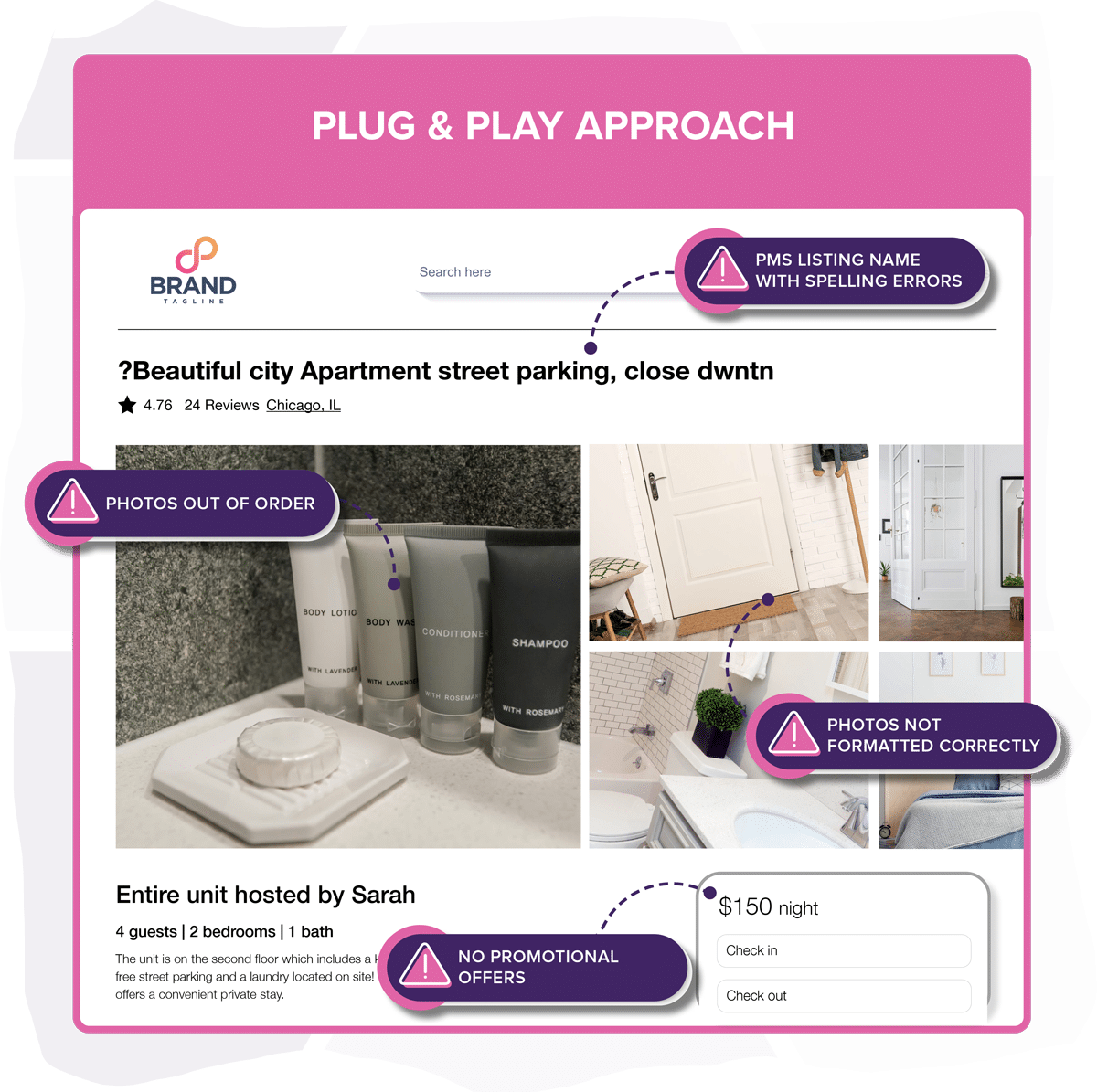

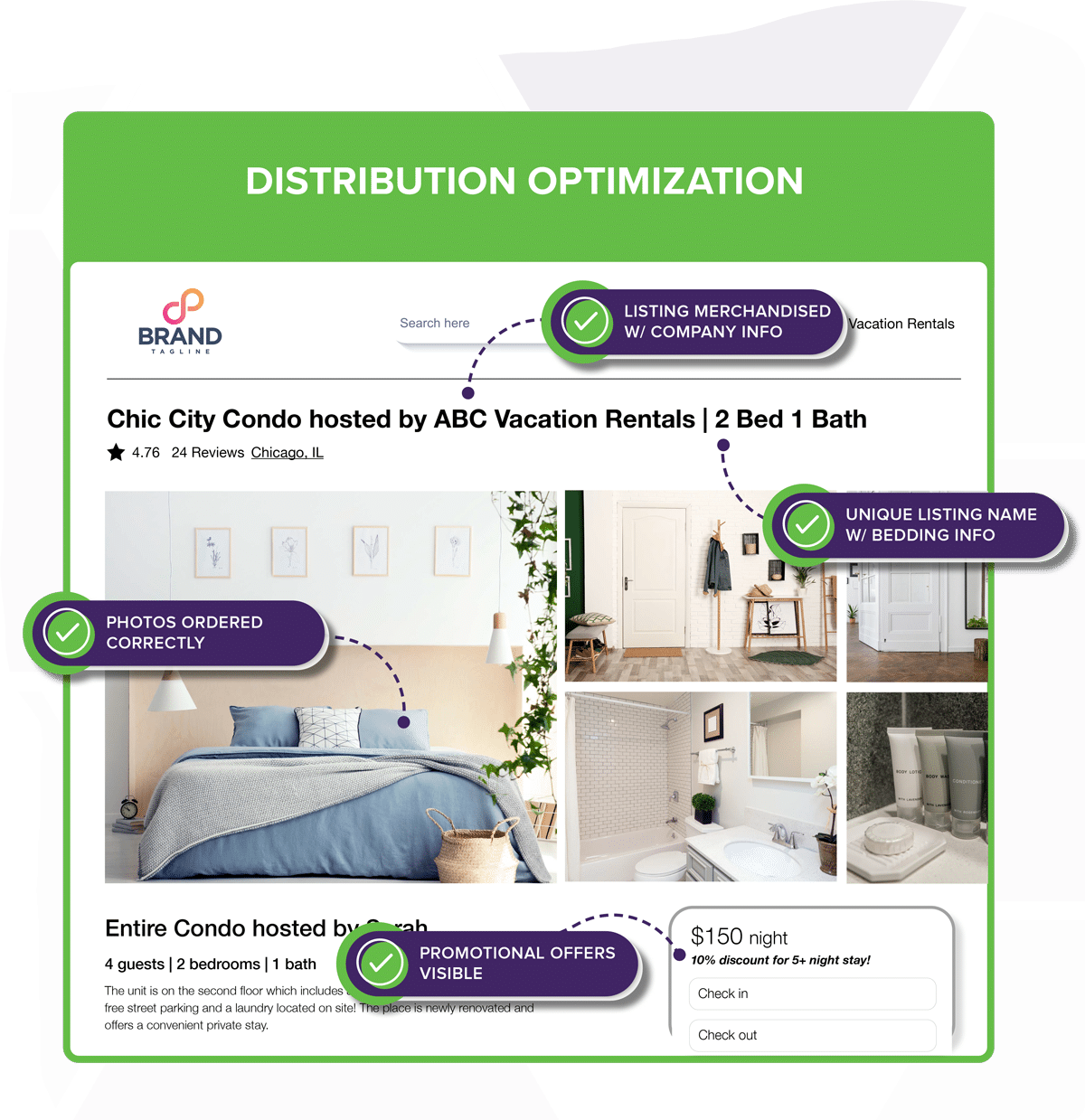

- Shore up your direct channel: If you’ve been considering a new website, digital marketing strategy, or payment solution, now’s the time. Let’s face it—margins continue to be razor thin. Set your OTA business to autopilot for a while and give your most profitable channel some love.

- New revenue streams or markets: When things are humming along, you may have less incentive or motivation to diversify your portfolio. Market insights from companies like KeyData can expose new opportunities while digging into set-it-and-forget-it revenue generators such as fees can set you up for future growth and stability.

- Fresh or improved talent: Investments in your staff during a slow market can help engender the loyalty you’ll want once things bounce back. Consider additional training or incentives so your best people don’t get poached by a competitor.

- New partnerships and collaborations: The same challenging market conditions that affect STRs impact other service providers in your area. Now is a great time to explore value-added collaborations or packages with complementary businesses. Not only might it help lure choosy guests, but you’ll build new or improved relationships that benefit you later.

The final word

New investments during a down market carry added risk, especially if the recovery takes longer than expected. Nobody wants to find themselves in a cash crunch when things get lean. Again, wait-and-see is a perfectly sensible strategy.

However, we believe that a slowdown makes it that much easier to charge ahead. Shifting into overdrive while your competitors are in neutral can put you in a much better position to nab market share as the market adjusts. It may seem counterintuitive, but bold business moves often do. As long as you know your business’ fitness level and act strategically, you can mitigate the risks and potentially leave the competition in the dust.