Manage complex tax situations with ease, speed, and accuracy

Track’s accounting features for vacation rentals save you time with all the tools, automations, and reporting you need to run a tight hospitality shop. Best of all, it’s flexible enough to adapt to your unique situation.

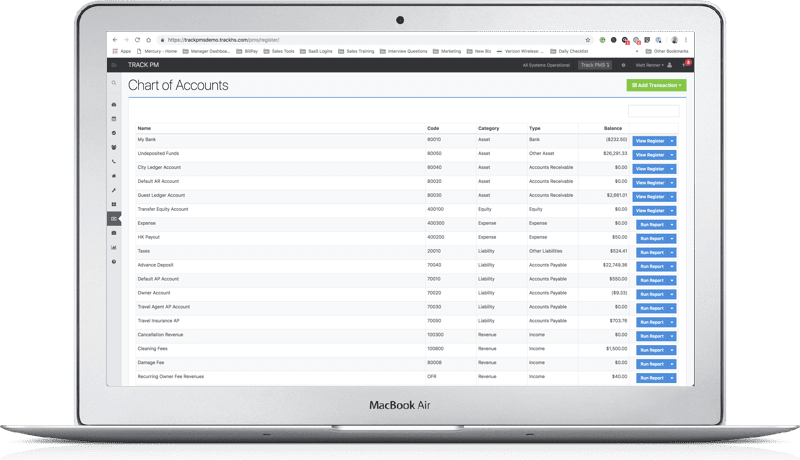

Configurable chart of accounts

Automated payments

Owner accounting

Recurring charges

Vendor billing

Customizable user roles

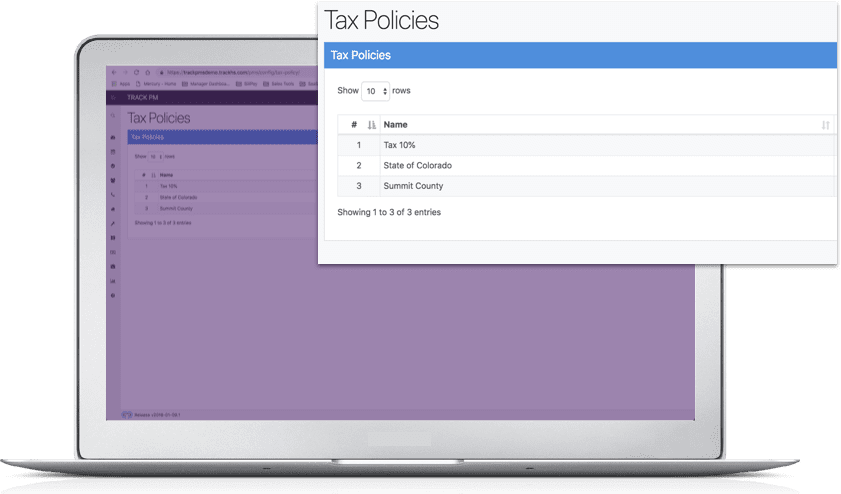

Tax policies and districts

ACH credit and debit

Complex tax situation? No problem.

Accurately and easily manage tax and use policies across multiple states, counties, and channels. Provide owners with 1099 and 1042 forms directly in the Owner Portal, and credit and debit funds via batch ACH.

Accurate data and reporting

New or enhanced reports recently released include:

Account Balance

Accounts Payable

Balance Sheet

City Account Balance

Master Folio Ledger

Property Ledger

Security Deposit Ledger

Supplemental Deposit Worksheet

Trust Account Journal

Un-Deposited Funds

Trust Accounting in Track

As any accountant will tell you, Trust Accounting is its own thing. The aspects that make it unique are the same that can make it challenging—especially for programs like QuickBooks that aren’t made to handle it. Fortunately, Track’s built-in Trust Accounting features make it easy and accurate.

Property management software

Track PMS integrates

Track PMS includes connectivity to many third party apps and has an API for connecting new applications.